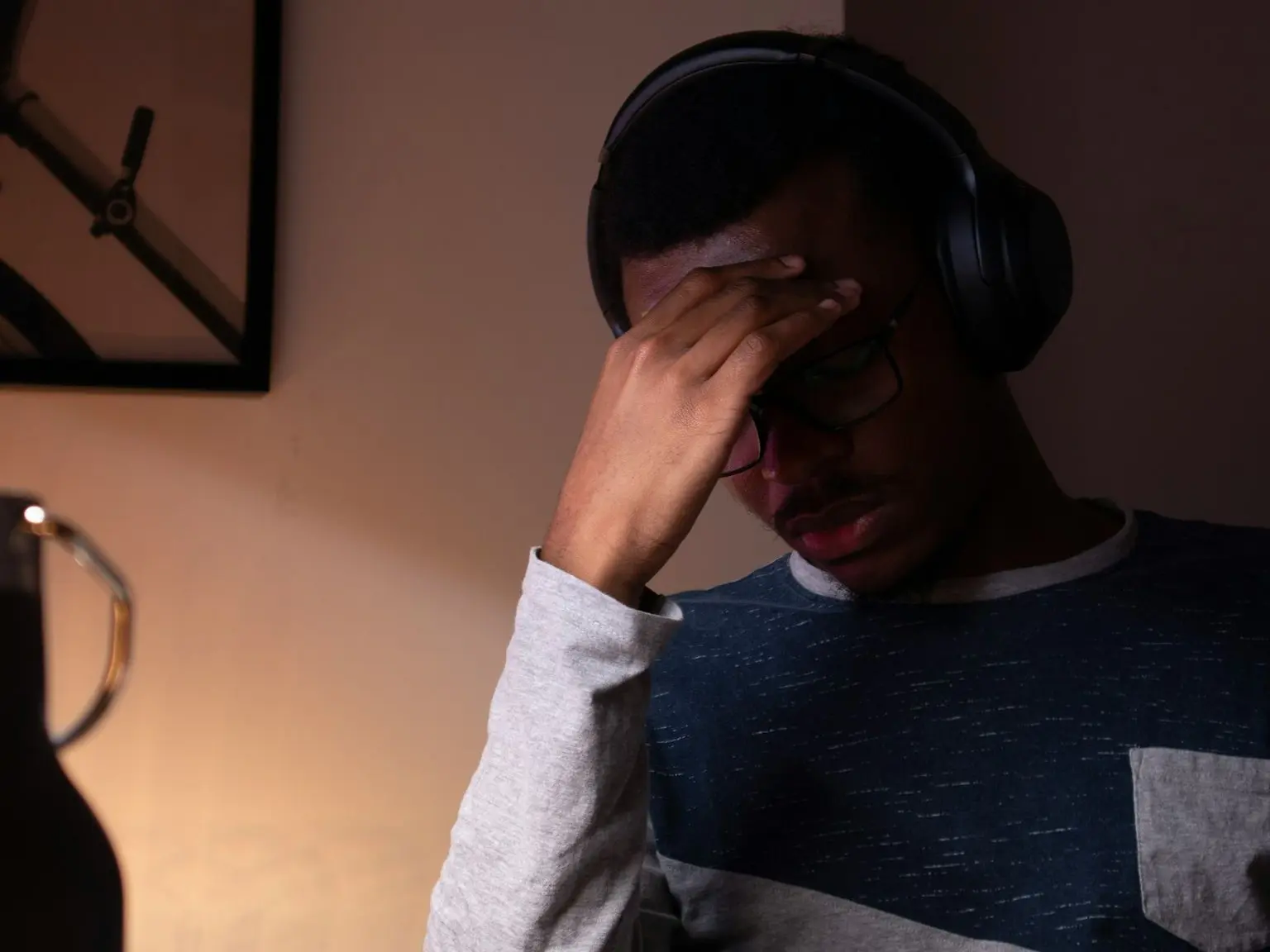

No administration?

During an inspection, the Tax Authority always assumes the highest amount.

Make sure you have the file in hand – before they ring the bell.

What can go wrong without evidence

Revenue overestimated → unjust extra VAT & profit tax

Fines + interest from day one that you are 'non-proven'

Time loss to interrogations, searching for documents and explaining what you should have been able to show

No receipt? No story. And so: pay.

How do we start?

1

Introduction

We are planning an informal conversation to discuss your situation and wishes.

2

Getting the administration in order

We bring structure and ensure that everything is up to date.

3

Together further

You receive clear reports and we actively think along with you regarding choices and changes.

What you get – every month

Realtime dossier-status in your own dashboard

Automatic VAT reservation so that you never miss out

Proactive alerts if pieces are missing

One fixed point of contact: quick call, clear answer

Outcome : accurate administration, direct te delen bij een boekencontrole. Geen stress, geen nacalculaties, geen slapeloze nachten.

Voorkom dat jij ‘verdachte’ bent

Eén gratis sparsessie minuten geeft je duidelijkheid:

Wat is de staat van je administratie?

Welke risico’s loop je nu?

Wat levert uitbesteden jou concreet op?

Klik op “Plan gratis adviesgesprek”.

Geen verplichtingen. Wel rust.